Rather than anticipating the direction of the reversal and entering into a new position, trend traders will use these signals to exit their current position. When price fails to reach anticipated support and resistance levels, or when a long-term moving average crosses over a short-term moving average, it’s thought to signal a reversal. In addition to providing insight into the current trend direction and strength, moving averages can also be used to gauge support and resistance levels. All moving averages are lagging indicators that use past price movement to lend context to current market conditions. To determine the direction and strength of the current trend, traders often rely on simple moving averages and exponential moving averages such as the moving average convergence/divergence (MACD) and average directional index (ADX). For obvious reasons, trend traders favor trending markets or those that swing between overbought and oversold thresholds with relative predictability.

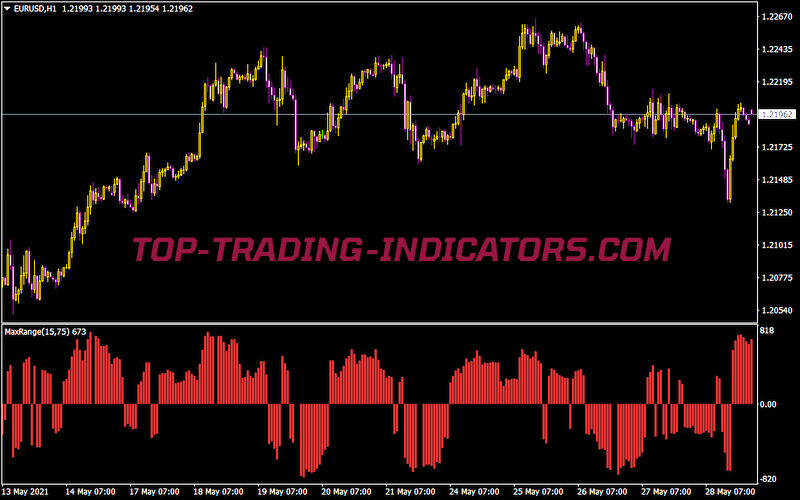

When investing in the direction of a strong trend, a trader should be prepared to withstand small losses with the knowledge that their profits will ultimately surpass losses as long as the overarching trend is sustained. For this reason, trend trading favors a long-term approach known as position trading. In a trend trading strategy, the trader doesn’t need to know the exact direction or timing of the reversal they simply need to know when to exit their current position to lock in profits and limit losses.Įven when a market is trending, there are bound to be small price fluctuations that go against the prevailing trend direction. All of these factors will tell them how strong the current trend is and when the market may be primed for reversal. In order to do so effectively, traders must first identify the overarching trend direction, duration, and strength. As the name suggests, this type of strategy involves trading in the direction of the current price trend. (riv-ay-TPOChart.v102-06 and riv-ay-MarketProfileDWM.Trend trading is one of the most reliable and simple forex trading strategies. It is VISUALLY BASED on the best TPO/Market Profile for MT4 More info: The Insync Index by Norm North, TASC Jan 1995 I have also provided an option to color bars based on the index value. The various values of the underlying components can be tuned via options page. Levels 95/5 are equivalent to traditional OB/OS levels. Note that, index > 75 (and less than 95) should be considered very bullish and index below 25 (but above 5) as very bearish. Īlso, since this is typical oscillator, look for divergences between price and index. This can be a great confirmation signal for price action + trend lines. Market is typically bullish when index is above 50, bearish when below 50. Buy when crossing up 5, sell when crossing down 95.

There are couple of ways to use this indicator. Basically, this index shows that when a majority of underlying indicators is in sync, a turning point is near. It uses RSI, MACD, MFI, DPO, ROC, Stoch, CCI and %B to calculate a composite signal. Insync Index, by Norm North, is a consensus indicator.

0 kommentar(er)

0 kommentar(er)